Until Insurance Function That You Need to Know, Why should you insure your life?

Why should you insure your life?

cuy.nyikunyit.com - There are many words like "should" and "ought" we use to tell ourselves and the world around us that we have obligations. There are other words to tell us what we want and need. When we put together all the pieces in a decision, we choose to do things when we have needs we cannot satisfy in any other way. So where do we start? It all starts with the word "I". There is always a "me", and what I have is "mine".

This is selfish. It may not be pretty, but nature has built it into us to help us survive. We are weak when born, depending on parents for everything. As we grow, we redefine the world into what is mine and yours until we have independence and the right to choose for ourselves.

When young, we never think of our own deaths. We do not have the experience to understand what effect an early death can have on those around us. So until we come to understand that death does affect people emotionally and financially, there is no perceived need to satisfy. We can assume there are no obligations to meet. We do not buy insurance for others.

Yet this is untrue. The moment to start to borrow money, say to go to college or buy a car, we do have obligations. Even if we die tomorrow before we marry and have children, someone, somewhere lost the borrowed money we did not pay back.

If there was an accident and we were checked into hospital so doctors could fight for our life, who picked up the cost of the treatment when we died? Who will pay for our burial? Now write in the names of our spouse and children, our parents, family and relatives, and our closest friends.

Why do we not think of their wants and needs? Is being one of a family in a community of friends not a system of responsibility to care for each other? If we did marry, the very least we should do is have enough insurance to pay off all the bills, including the mortgage, and leave him or her with a clean slate to start over. If there are children, we leave enough to contribute towards their future. Then we can die with a clear conscience.

Life insurance has a strange reputation. We rarely talk about it because we prefer not to talk about our own death. But that is no excuse. Everyone should step up to the plate and make arrangements for those who will survive us. They depend on us now.

That dependence is still there when we die. If we do not leave enough money behind us, the need is there without any means of satisfying it. This is not rocket science. You need to start thinking about life insurance so those you leave behind will have the money to survive life without you.

As one of the non-bank institutions, insurance is a good investment alternative and minimizes the risk of unexpected events.

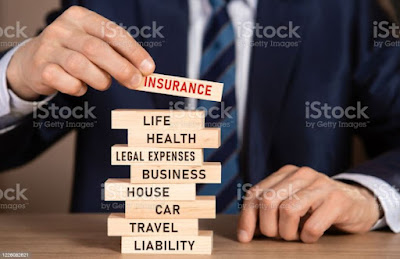

Basically, insurance is divided into three major categories, namely life insurance, psychiatric insurance, and loss insurance. But the division is still common, there is a division of types of derivative insurance from the three types of insurance.

This time, let's look at the simplest understanding of insurance and the functions and benefits of insurance

Understanding, Purpose Until Insurance Function That You Need to Know

According to the language, insurance comes from the English language that is insurance which means coverage.

According to Law No. 2 of 1992, insurance is an agreement between two or more parties, in which the insurer binds itself to the insured, by receiving insurance premiums, to provide reimbursement to the insured for loss, damage or loss of expected profit or responsibility of a third legal party that may be suffered by the insured, arising from an uncertain event, or providing a payment based on the death or life of an insured person.

The term insurance describes every action for protection against risk. Insurance users are given the obligation to pay a certain amount of money called premiums, which are paid to insurance companies.

Insurance Objectives

The purpose of insurance is basically just in case of a risk in an event.

The other purposes of insurance are as follows:

1. Provide guaranteed protection from the risks of losses experienced by one party.

2. As an equalization of costs, that is enough just to spend a certain amount of money and do not have to reimburse yourself for losses that occur with an uncertain and uncertain amount.

3. Increase efficiency, because there is no need to specifically conduct supervision and security to provide protection that spends a lot of time, effort and cost.

4. As a savings account, because the amount paid to the insurance company will be refunded in a larger amount than before. (This is especially the case with life insurance).

5. The basis of the bank to provide credit, because the bank itself requires a guarantee or protection of the money given to the borrower's money.

6. Closing the loss of earning power of a person or a business entity at the time he does not work or does not function.

7. To switch the risk that originally existed on the part of the owner to the insurance party who is ready to accept the risk.

8. To compensate the parties for losses and benefit in addition to providing some guarantees to the insurance participants.

Insurance Function

In addition to controlling a risk that occurs, insurance also has several other functions, namely as follows:

1. Fund raiser

The task of insurance companies is to raise incoming funds. Good business management requires the incoming funds to be invested, so that the funds are more productive.

Investment activities carried out by insurance companies in addition to supporting national development, can also reduce the cost of insurance, where with the profit or profit obtained through investment funds, the element of profit presentation taken into account in the determination of premiums can be reduced.

2. Help for business companies

Insurance encourages the establishment of a business, an investor who plans to invest in a particular business, it is possible to cancel the plan, because it does not want to assume the risk in the event of a disaster.

With insurance, an entrepreneur will avoid anxiety in case of risk, so that more can focus on the efficiency of his business.

So if a person pays a small premium, he can take advantage of the capital that should be for the loss fund, thus he can expand and improve his business and if such risks occur, the continuity of his business will be more guaranteed.

3. Risk reduction

There are recommendations given by insurance companies after a risk survey is conducted to the insured through surveyors, to correct a risk with the prevailing premium rate system. For example with its own risk burden, discounts, research and publications on the way and cause of loss, with certain efforts or actions.

Therefore, insurance companies make an important contribution to economy by how to minimize the possibility of a risk.

4. Spread losses evenly

With the spread of losses evenly can be interpreted that the amount of dues or contributions paid by the insured for premium funds is balanced with a risk transferred.

Types of Insurance

The types of insurance are as follows:

1. Health insurance

Health insurance is an insurance that provides insurance against health problems caused by an illness or accident.

2. Life insurance

Life insurance is an insurance that guarantees the death of an insured person by providing financial benefits.

3. Vehicle insurance

Vehicle insurance is a type of insurance that provides insurance services to vehicles that experience loss, damage, and so on.

4. Education insurance

Education insurance is insurance that guarantees a good educational life. For example, Prudential and BNI Life Insurance.

5. Business insurance

Business insurance is insurance that guarantees against the company in business activities covering considerable amounts of losses, damages, and losses.

6. Home and property ownership insurance

Home and property ownership, insurance is an insurance that provides services to homeowners from risks such as residential damage or damage to personal belongings.

So that's the article above that discusses about [Understanding, Purpose, Function, Type] Insurance. Hopefully it can add insight and benefit you.

see you again. :))